Overview

The GST Accounting course has the objective of providing practical hands-on experience in applying required GST treatment on business transactions, key controls together with reporting and tax return requirements. After the course, the attendee should have a good understanding of the key elements of GST and be able to manage basic GST requirements with an accounting software.

Basic GST and product knowledge is required to maximize the benefit from this course.

Syllabus

Setup and Settings

- Enabling GST Features

- Maintaining Key Data Elements for GST Reporting

Transactions

- GST in Purchasing

> Supplier Invoice

> Adjustments

> Sundry Purchases

> Self-Billed Invoice

> Invoices more than 6 months

> Capital Goods

> Imported Services

- GST in Sales

> Tax Invoice

> Adjustments

> Bad Debt Relief and Recovered

- GST in Receipt

- Posting

Reports

- Source Documents for GST

- GST Return - GST-03

- GST Audit File – GAF

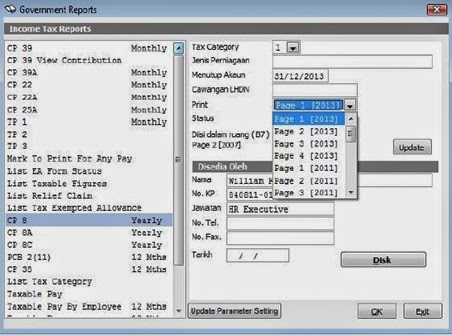

- Tax Reports

For more detail, please visit www.vivid.com.my or please call 03-91722228.