Vivid Solutions Sdn Bhd

Thursday, December 21, 2023

Access UBS Accounting - Where to change tax code setting?

Vivid Solutions Sdn Bhd

Monday, November 20, 2023

Access UBS 2023.3 Release Notes

iAssist

Introducing the new iAssist feature, equipped with drag-and-drop capabilities to provide enhanced visibility into the entire document journey within the transaction cycle. With this innovative feature, users can effortlessly monitor document progress, gain valuable insights into their position within the transaction cycle and make well-informed decisions. This advancement promotes transparency and efficiency, empowering users to manage their tasks more effectively and with greater confidence.

Log in to Inventory and Billing and you will noticed a new feature named “iAssist” added to the business transactions list on the left panel – refer image below:

Document Attachment (Master File and Email sending)

Do you struggle to keep track of essential information stored within your system's transactions? Document Attachment is here to help. Our new feature allows you to easily attach and retrieve documents within your transactions. No more wasting time sifting through endless data or manually searching for documents. With Document Attachment, you can collect and organize all your transaction-related documents in one place, making it easy to stay on top of your business. Say goodbye to the hassle of manual document management and try our new Document Attachment today.

The document attachment capability is now expanded to Master files such as Customers, Suppliers, and Items. This enhancement enables you to seamlessly attach and retrieve documents within your core data files. Furthermore, Document Attachment is also incorporated into our email feature, streamlining the process of including crucial attachments when sending emails through our solution.

The new Document Attachment tab is added to the maintenance screen and now accessible in the following master types:

Supported file and image types:

Sample of the Customer Maintenance screen with Document Attachment in respective mode:

Add mode:

View and Edit mode:

Email:

If there are attachments in the transaction, same list of files will be listed for you to select and email to your customer. Please note that the maximum file size per email is 20MB.

To further assist you, default Attach to email functions has been added to Attachment in the transaction which allow you to automatically include the selected file when emailing.

Product Policy

Update on Product Terms and Conditions

Product Terms and Conditions have been updated; you can view the content from the following screens. Please ensure that you are connected to the internet before clicking on the menu.

General

View Previous Year DataIn order to enable you to view the attachments within your system, you are required to link the accounting folder for accessing the previous year Inventory & Billing data. The same procedure applies to access previous year accounting data.

Important Note:

Whether it is a single module (Accounting or Inventory & Billing) or both, you must perform the required mapping in the Previous Year Data settings because of the shared master files data.

Example: If you are solely using the Accounting module, without Billing, and running Year-End procedures exclusively in the Accounting module, you should select the main folder associated with your company name, eg: ABC Sdn Bhd.

Vivid Solutions Sdn Bhd

Friday, November 03, 2023

Updates on einvoicing

When do I need to start eInvoicing?

The implementation will occur gradually, starting in August 2024 as below:1 Aug 2024 -For businesses with an annual turnover of RM100 million or more

1 Jan 2025 - Businesses with an annual turnover of RM25 million to RM100 million

1 Jul 2025 - eInvoice becomes mandatory for all taxpayers in Malaysia

However, businesses can voluntarily embrace e-invoicing from 1 January 2024.

Why eInvoicing?

eInvoicing Software FAQs

Why do I need eInvoice in Malaysia?- Adopting eInvoice in Malaysia is essential for several reasons outlined in the LHDN guidelines. Firstly, eInvoice ensures compliance with the Inland Revenue Board (LHDN) regulations, helping businesses adhere to legal requirements. Secondly, it significantly reduces processing costs for each invoice, potentially up to 80%, leading to substantial savings. Moreover, eInvoice accelerates payment processes, improving cash flow and improving businesses' financial stability. Embracing eInvoice simplifies invoicing procedures and aligns seamlessly with the LHDN Malaysia regulations, making it a practical and efficient choice for businesses operating in Malaysia.

What is eInvoice?

- eInvoice, per the guidelines provided by LHDN Malaysia, refers to the electronic version of traditional paper invoices. It's a digital method businesses use to create, send, receive, and manage invoices over the internet. These electronic invoices are structured data files that adhere to a standardized format, ensuring consistency and compliance with LHDN regulations. eInvoice simplifies the invoicing process, reduces paperwork, and enables secure and efficient exchange of invoices between suppliers and buyers. It is crucial in enhancing business efficiency, cutting costs, and ensuring compliance with LHDN Malaysia guidelines.

Why is eInvoice important to your business?

eInvoice is crucial for our business because it ensures compliance with the guidelines set by LHDN Malaysia. By adopting eInvoice, we streamline your invoicing process, reduce operational costs significantly, and enhance overall efficiency. This compliance saves time and money and ensures that our business operations align seamlessly with the regulations, guaranteeing smooth transactions and financial stability.

What are the benefits of eInvoice?

eInvoice eliminates the need for sellers to print paper invoices or create PDFs for mailing or emailing to buyers. Buyers no longer have to input invoice data into their accounting systems manually. This method enhances accuracy and security, speeding up processing times and payments.

In summary, the benefits of eInvoice include:

1. Reduced administrative work for both buyers and sellers.

2. Faster payments for sellers.

3. Cost savings for both buyers and sellers.

4. Fewer errors for buyers and sellers.

5. Direct and secure connections between buyers and sellers.

6. Reduced environmental impact.

If you have any questions, please do not hesitate to reply back to below information, I will be able to assist you further.

Thursday, August 17, 2023

LHDN introduce e-Invoice in 2024

Introduction

An e-Invoice is a digital representation of a transaction between a supplier and a buyer. e-Invoice replaces paper or electronic documents such as invoices, credit notes, and debit notes.

An e-Invoice contains the same essential information as traditional document, for example, supplier’s and buyer’s details, item description, quantity, price excluding tax, tax, and total amount, which records transaction data for daily business operations.

Benefits of e-Invoice

The implementation of e-Invoice not only provides seamless experience to taxpayers, but also improves business efficiency and increases tax compliance. Overall benefits include:

- Untitled Invoicing process.

– Streamlining of transaction document creation and submission, and automation of data entry for transaction made. - Facilitated tax return filling.

– Seamless system integration for efficient and accurate tax reporting. - Enables streamlining of operations.

– Enhanced efficiency and significant time and cost savings for larger business. - Digitalized financial reporting.

Aligns financial reporting and processes to be digitalized with industry standard for micro, small and medium sized enterprises.

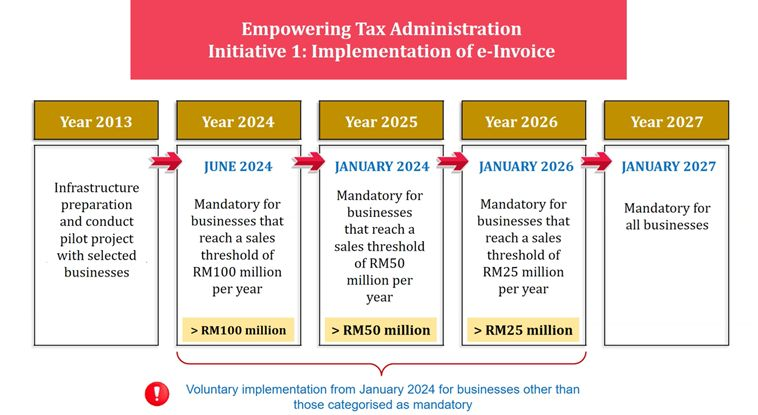

e-Invoice Implementation Timeline.

Sample E-Invoice

Reference

- Seller’s & Buyer’s Tax Identification Number (TIN)

- Company / Business Registration Number

- E-Invoice Date

- E-Invoice Unique Serial Number

- Product Code (Barcode / QR)

- Product / Service Description

- Transaction status

- Details of product / service (Quantity, unit price)

- Discount offered

- Itemised amount payable excluding tax, tax amount, amount including tax and tax rate / tax relief

- Total amount payable including tax

根据内陆税收局(LHDN)最新的消息就指出,电子发票系统(e-invois)将会分阶段落实,明年将会是指定企业试点落实。一旦电子发票系统全面落实推行之后,民众就不需要保存发票长达 7 年了。

据悉,电子发票系统(e-invois) 将于 2024 年 1 月份开始对指定的企业进行试点推行。在 2024 年 6 月份时,则会对营业额超过 1 亿令吉的企业强制要求使用电子发票系统。

到了 2025 年 1 月份时,则会对营业额超过 5000 万令吉的企业强制使用,以及在 2026 年 1 月份时则对营业额超过 2500 万令吉的企业强制使用。最后到了 2027 年 1 月份时,所有企业都必须使用电子发票系统

Thursday, August 10, 2023

Access UBS Software Bundle Promotion

UP to 40% off your Finance & Accounting, Payroll and HR Software.

From now till 31 October, tap into our Access SME Software Bundle

and enjoy discounts off our Finance & Accounting, Payroll, and HR business

solutions.

Select 2 products and save 30%* | Select 3

products and save 40%*

Solutions offered in our bundle promotion include:

- Finance & Accounting software - Access UBS One Accounting & Billing, Access UBS

Accounting & Billing and Access UBS Inventory & Billing

- Payroll software

- Access UBS Payroll and Access EasyPay (desktop or cloud-hosted)

- HR software

- Access Workspace HR Starter Pack and Access People HR

* Discounts are applicable only for software purchased on

subscription.

Saturday, July 22, 2023

Access UBS Payroll 2023.6 Release Notes

Malaysia Statutory Update

Update on TP 1 Tax Form

Updated TP 1 form to the latest template from LHDN.

Update on TP 3 Tax Form

Updated TP 3 form to the latest template from LHDN.

Breakdown on Additional Lifestyle Reliefs

As per the latest template of TP1 Tax Form YA2023, the system needs to capture and show the breakdown relief amount of additional Lifestyle relief to:

• Item C6 a) Lifestyle (sport equipment)

• Item C6 b) Lifestyle (rental/entrance fees of sport facility)

• Item C6 c) Lifestyle (registration fees for approved sport competition)

Thus, in Settings > Payroll Settings > Statutory / Tax Tables Maintenance Setting > Tax Relief Table:

• The description of TR0040 changed from ‘Lifestyle - Sport’ to 'Lifestyle (sport equipment)'.

• Added new tax relief TR0048 Lifestyle (rental/entrance fees of sport facility).

• Added new tax relief TR0049 Lifestyle (registration fees for approved sport competition).

• The sum of TR0040, TR0048 & TR0049 relief amounts should be capped at RM 500.

New Tax Type for C-Suite Position

To encourage high value employees to work at Malaysia, a flat tax rate of 15% is given to non-individual citizens who reside in Malaysia and hold the position of C-Suite in companies that have approved the placement incentive scheme manufacturing operations back to Malaysia.

Encouragement for a flat tax rate of 15% to the C-Suite serving in eligible Electrical and Electronic (E&E) companies is also extended for another 2 years. This incentive extension proposal is effective for applications accepted by MIDA from 1 January 2023 to 31 December 2024.

If the chargeable income does not exceed RM35,000, employee is eligible for individual and spouse rebate for RM400, respectively

New tax type C-Suite is now available in Employee details > Statutory Info screen:

PCB Constant Value table of C-Suite tax type:

Bank Files Update

The below section describes the features in more detail, including screenshots and videos where appropriate, this is ordered by the products/modules identified in Release Summary section.

Affin Bank (Affin Max)

Friday, June 23, 2023

Access UBS Payroll 2023.4 & 2023.5 Release Notes

This release encompasses our efforts to ensure our product in compliance with government statutory policy, specifically in Year Assessment 2023 Malaysia income tax rate and tax relief changes.

Also, it contains the hotfix for the truncation of bank account numbers in bank files that include bank account numbers in their file contents and fixes incorrect Kod Majikan (employer File No.) in EIS Lampiran 1 excel.

Malaysia Statutory Update

Update on Resident Tax Type Income Tax Rate

The calculation of Resident Tax Type income tax contribution amount has been updated according to the rate changes in Malaysia Budget 2023 which takes effective from June 2023.

Update on Tax Reliefs

Updated the Tax Relief Table as per relief changes in Malaysia Budget 2023 which takes effective from June 2023:1. The medical treatment expenses relief limit to be increased from RM8,000 to RM10,000. (Relief Codes TR0006, TR0036)

2. The scope of medical treatment expenses relief is expanded to include intervention expenditure for Autism, Attention Deficit Hyperactivity Disorder (ADHD), Global Developmental Delay (GDD), Intellectual Disability, Down Syndrome and Specific Learning Disabilities, limited to RM4,000. (Relief Code TR0047)

3. Extension of tax relief on net deposit into the Skim Simpanan Pendidikan Nasional (SSPN) until the year of assessment 2024. (Relief Code TR0009)

Note: The tax relief limit for medical treatment expenditure for self, spouse, or child of RM10,000 has the latest scope below:

1. (Relief Code TR0006) serious illness for taxpayer, spouse, or child; (limited to RM10,000)

2. (Relief Code TR0036) fertility treatment for taxpayer or spouse; (limited to RM10,000)

3. (Relief Code TR0024) full medical check-up including mental health check-up or consultation, COVID-19 detection test inclusive of the purchase of self-test kit for taxpayer, spouse or child limited to RM1,000;

4. (Relief Code TR0039) vaccination for taxpayer, spouse or child limited to RM1,000.

5. (Relief Code TR0047) medical intervention expenditure for Autism, Attention Deficit Hyperactivity Disorder (ADHD), Global Developmental Delay (GDD), Intellectual Disability, Down Syndrome and Specific Learning Disabilities limited to RM4,000

Enhancement on Moden View Features

More Employee Details on Generate Report

Added Zip / Postal code, State / Province, Email, Religion & Age (as of current calendar year) column options for Reports > Employee Overview Reports > Employee Reports > Generate Reports, group the column options by information type in the report filter screen and adjusted the column sequences in the exported excel for better user experience.

Expand Length of File Directory

The path lengths of the file directory fields below have been expanded from 50 characters to a maximum limit (up to 170 or 250

characters):

1. (Top right) Profile drop down > Backup & Restore > Backup

2. (Top right) Profile drop down > Backup & Restore > Restore

3. (Top right) Profile drop down > Backup & Restore > Scheduled Auto Backup

4. Integration > Post to UBS Accounting > Company Totals

5. Integration > Post to UBS Accounting > Branch to Branch Account

6. Integration > Post to UBS Accounting > Category to Category Account

7. Integration > Post to UBS Accounting > Department to Department Account

8. Integration > Post to UBS Accounting > Line No. to Line No. Account

9. Integration > Post to UBS Accounting > Project to Project Account

10. Integration > Import / Export > Import / Export Payroll Records

11. Integration > Import / Export > Import / Export HRMS Files

12. Integration > Import / Export > Export Payroll Records to Excel

13. Integration > Import 1st Half > Import from Access Expenses

14. Integration > Import 1st Half > Import from FingerTec

15. Integration > Import 1st Half > Import from Payroll.TXT

16. Integration > Import 1st Half > Import from Payt9.DBF

17. Integration > Import Month End / 2nd Half > Import from Access Expenses

18. Integration > Import Month End / 2nd Half > Import from FingerTec

19. Integration > Import Month End / 2nd Half > Import from Payroll.TXT

20. Integration > Import Month End / 2nd Half > Import from Payt9.DBF

Bank Files Update

Ambank

Affin Bank (Affin Max)

Saturday, June 10, 2023

Access UBS Amnesty Campaign

In conjunction with this new release, now having a promotion for you as we noted that you are no longer active on

Access Cover. Come back today as our active customer without any additional

charges and enjoy all the latest update in our software.

It's been a while since your Access UBS Cover expired. Since then, we've made many updates and enhancements to Access UBS products so that our users find it much easier to work. Here are few reasons to come back today:

- Get the latest product updates: Always have the latest version of UBS to ensure you keep up with the local legislations.

- Get the best offer: Don’t’ miss out on our Access UBS Amnesty Campaign, come back as our active customer without having to pay any penalties!

- Our new feature - Document Attachment that allows you to easily attach and retrieve documents within your transactions. No more wasting time sifting through endless data or manually searching for documents.

- Improvements to commonly used functions. We have resolved several issues that were impacting the functionality of our solution and we are confident these fixes will improve performance and make for a smoother user experience.

If you are interested in learning more about this exclusive offer, please contact us using the details provided below. Terms & conditions apply.

Friday, June 09, 2023

Access UBS Payroll - Promotion June 2023

- Offering 1 additional User License (optional to add additional incentive) with any purchase of UBS Payroll 30 or above before 30th June 2023.

Why should you consider purchasing UBS Payroll?

- Stay

Compliant

- Manage multiple companies

- Comprehensive HRMS capabilities, including Leave

and Claims management

- Flexible Payroll Processing

- Integration

with UBS Accounting

With our newest release, you will enjoy

our new & improved design and useful features such as combined EIS/SOCSO

submission.

Learn more about UBS Payroll here.

Furthermore, as part of this exclusive offer, you will be eligible to receive 50% discount plus free Implementation for Access Analytics. Access Analytics provides you with useful tools like UBS Analytics, Collaborate, Learning Lite and more.

If you are interested in learning more about this exclusive offer, please contact us using the details provided below. Terms & conditions apply.

Thursday, June 01, 2023

Access UBS 2023.2 Release Notes

Newest Access UBS Accounting version 2023.2 release will be available from Tuesday 06 June 2023.

In this newest release, you’d gain greater efficiency and accuracy of transaction processes, making it easy to stay on top of your business.New feature - Document Attachment that allows you to easily attach and retrieve documents within your transactions. No more wasting time sifting through endless data or manually searching for documents.

The inclusion of the Demo Company is part of the two (2) companies provided upon activating the Access UBS One license. Originally intended as a reference company, it allows users to familiarize themselves with the system and understand data setup and usage.

Remove Create and Delete company functions

Create Company

With the provision of two (2) automatically created companies, namely SAMPLE COMPANY and New Company, the system already fulfils the company count requirement. Therefore, you will not be allowed to create any additional companies beyond this limit – refer image below on the message prompt.

Delete Company

Vivid Solutions Sdn Bhd