Introduction

An e-Invoice is a digital representation of a transaction between a supplier and a buyer. e-Invoice replaces paper or electronic documents such as invoices, credit notes, and debit notes.

An e-Invoice contains the same essential information as traditional document, for example, supplier’s and buyer’s details, item description, quantity, price excluding tax, tax, and total amount, which records transaction data for daily business operations.

Benefits of e-Invoice

The implementation of e-Invoice not only provides seamless experience to taxpayers, but also improves business efficiency and increases tax compliance. Overall benefits include:

- Untitled Invoicing process.

– Streamlining of transaction document creation and submission, and automation of data entry for transaction made. - Facilitated tax return filling.

– Seamless system integration for efficient and accurate tax reporting. - Enables streamlining of operations.

– Enhanced efficiency and significant time and cost savings for larger business. - Digitalized financial reporting.

Aligns financial reporting and processes to be digitalized with industry standard for micro, small and medium sized enterprises.

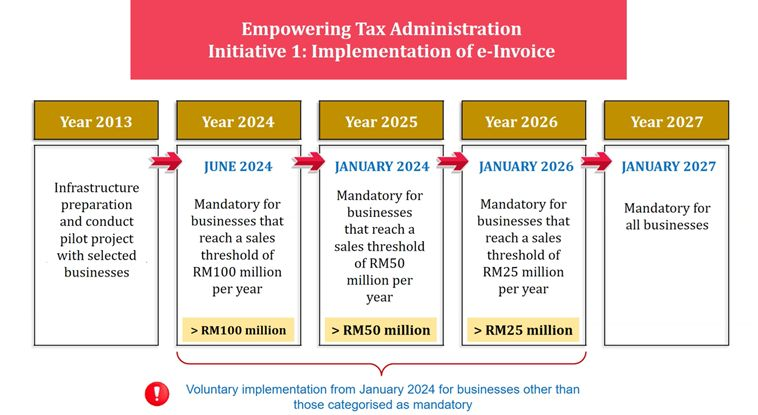

e-Invoice Implementation Timeline.

Sample E-Invoice

Reference

- Seller’s & Buyer’s Tax Identification Number (TIN)

- Company / Business Registration Number

- E-Invoice Date

- E-Invoice Unique Serial Number

- Product Code (Barcode / QR)

- Product / Service Description

- Transaction status

- Details of product / service (Quantity, unit price)

- Discount offered

- Itemised amount payable excluding tax, tax amount, amount including tax and tax rate / tax relief

- Total amount payable including tax

根据内陆税收局(LHDN)最新的消息就指出,电子发票系统(e-invois)将会分阶段落实,明年将会是指定企业试点落实。一旦电子发票系统全面落实推行之后,民众就不需要保存发票长达 7 年了。

据悉,电子发票系统(e-invois) 将于 2024 年 1 月份开始对指定的企业进行试点推行。在 2024 年 6 月份时,则会对营业额超过 1 亿令吉的企业强制要求使用电子发票系统。

到了 2025 年 1 月份时,则会对营业额超过 5000 万令吉的企业强制使用,以及在 2026 年 1 月份时则对营业额超过 2500 万令吉的企业强制使用。最后到了 2027 年 1 月份时,所有企业都必须使用电子发票系统